This Wednesday, March 25, the Brewers Association, Fremont Brewing Company, and representatives from more than 20 other American craft breweries descend upon Washington, DC in support of the Small BREW Act. As we’ve reported before, the Act would reduce the per-barrel federal excise tax rate paid by breweries from $7 per barrel to $3.50 per barrel for the first 60,000 barrels produced. (See our previous story for more info.)

“Small breweries create jobs, drive beer innovation, and provide neighborhood space for community building,” said Sara Nelson, Co-Founder of Fremont Brewing. “I’m going to D.C. to ask Congress to support the Small BREW Act and help us invest even more in our local economy.”

Nelson plans to meet with Representatives David Reichert (Washington’s Congressional District 8), Susan DelBene (Congressional District 1), and Rick Larsen (Congressional District 2). She will also participate in a dinner for reporters of national media outlets, the purpose of which is to educate members the media about the Small BREW Act and discuss its importance to small brewers.

To learn more about the Small BREW Act, and what’s happening in Washington, DC, see our previous post.

Why Support the Small BREW Act?

Beyond reducing a tax burden, why is the craft beer industry (in large) fighting for the Small BREW Act? More importantly for this forum, why should beer consumers care?

Maybe you just want to drink beer, don’t want to concern yourself with this kind of stuff, and consider this an industry matter and not a public matter. That’s an understandable position, but many craft beer drinkers are also enthusiasts and support the industry beyond simply drinking beer. That’s why I present this information.

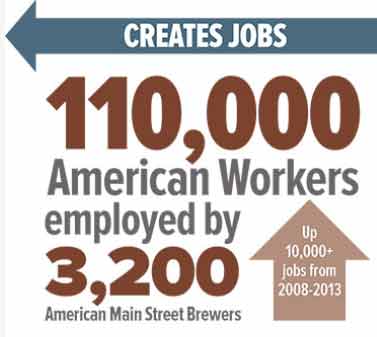

The term BREW is an acronym for Brewer Reinvestment and Expanding Workforce. The whole point of the Small BREW Act is to allow breweries to expand operations, hire new employees, and drive innovation. In theory at least, growth and innovation are good for consumers. Below, I explain the nuts and bolts in greater detail, but what about some real world examples?

Real Numbers

We need real examples from real breweries. How much money would the Small BREW Act free-up for reinvestment? One brewery provided me with a specific plan. Otherwise, we can look at the numbers and see what kind of capital is involved.

“If [the Small BREW Act] passes, we’d use the savings to hire two more people and buy another fermenter,” says Nelson.

That’s tangible. I’ve asked other breweries to provide concrete examples, but have not received any responses yet. Likely, they’re too busy with day-to-day operations to focus on the “what ifs” of tomorrow.

Looking at a couple of random examples…

Based on 2013 production numbers, Georgetown Brewing produces 52,300 barrels, paying an estimated $366,100 in federal excise tax. If the Act passes, that number would be reduced to $183,050, thus freeing up $183,050 for reinvestment. Another random example, based on 2013 numbers, No-Li Brewhouse in Spokane produced 6,000 barrels, thus paying about $42,000 in excise tax. That number would be reduced to $21,000, freeing up $21,000 for reinvestment.

To be fair, all of this assumes that reinvestment is how a brewery would use the savings. Also, to be fair, it should be noted that in 2013 only 22 of Washington’s 200+ breweries produced more than 3,000 barrels. (See our report from last June.) For the majority of the state’s breweries, the savings would be welcome, but the impact of the savings would be relatively small. In other words, if a brewery saves $3,000 or $4,000, it’s not likely that money will buy a new stainless steel fermenter or hire a new employee. But every bit helps and every small brewery dreams of growing.

Nuts and Bolts

As far as the recovery and growth of our national and local economy is concerned, studies show that the Small BREW Act’s reduction in tax revenue is outweighed by the positive economic impact. In other words, studies show that the less federal excise tax America’s small breweries pay the more money they will end up investing in growing the economy.

According to a report from the Brewers Association (available here), the proposed change in the federal excise tax on beer production would increase economic activity by at least $205 million in the first year and $ 1.2 billion over five years. It would also generate about 6,000 new jobs over the first 12 to 18 months, followed by an average of about 570 new jobs per year thereafter.

The new rate of $3.50 per barrel for breweries producing less than 60,000 barrels per year would provide approximately $28-$32 million per year (based on 2012 data) to help strengthen America’s craft brewers and support their efforts to maintain and generate jobs.

Today, once production exceeds 60,000 barrels, a small brewer must pay the same $18 per barrel excise tax rate as the nation’s largest breweries. In other word, a brewery the size of Georgetown Brewing (52,300 barrels in 2013) is frightfully close to paying the same tax rate as Anheuser-Busch (99 million barrels in 2013). Many beloved craft breweries are already in that position (Sierra Nevada, Deschutes, Dogfish Head, Brooklyn, Founders, Stone, and many more).

The Small BREW Act increases the threshold for that maximum tax rate from 60,000 to 2 million barrels.

Adjusting the tax rate to $16 per barrel on beer production above 60,000 barrels up to 2 million barrels would provide small brewers with an additional $32 million per year (based on 2012 data) that would be used to support significant long-term investments and create jobs by growing their businesses on a regional or national scale.

For a lot more information, visit the Government Affairs section of the Brewers Association website.

Interested in pledging your support and letting your congress know how you feel? Click here to find out how.

There’s a saying “When elephants fight, it’s the grass that loses.”

“For the majority of the state’s breweries, the savings would be welcome, but the impact of the savings would be relatively small. In other words, if a brewery saves $3,000 or $4,000, it’s not likely that money will buy a new stainless steel fermenter or hire a new employee.”

Bingo. So I get $3k dollars. Very nice. Wouldn’t say no. But it won’t make or break us. I’ll probably make some minor repairs and improvements. Loves me some routine maintenance!

But please explain to me how Georgetown getting a $180k tax break, or Fremont, or Mac and Jacks, or Ninkasi, Stone, or any of the out of state breweries in this market, helps me, or any of the other neighborhood small brewers, actively competing against these bigger local and regional players? How does this help the vast majority of WA’s brewers who are producing less than 3000 barrels, trying to grow their breweries, and competing in an ever more crowded market?

It’s sad, but the industry is stratifying. As they grow, regional players are using the craft beer banner of “Fight the Big Guys!” to pad their own coffers in order to grow even larger as they compete with each other and with the Big Three. Meanwhile the smaller brewers take one step forward and two steps back. A tax break above 60,000 barrels? That’ll do me a whole lot of good. If my brewery magically becomes 30 times larger. And I’m sure all the extra tanks, gear, sales and marketing staff it’ll afford the larger breweries as they compete with each other will really help smaller brewers sell their own beer.

I don’t support either these acts at all, and if you like small, neighborhood breweries, you shouldn’t either. The Small BREW Act disproportionately favors Regional Craft Breweries at the expense of the vast majority of small breweries.

You are wrong, Beer Intelligentsia. The Small BREW Act (H.R. 232/S. 375) would provide federal excise tax relief for every one of the approximately 3,200 small brewers and brewpubs in America. A “regional brewery” produces 15,000+ barrels/year. We produced 18,000 last year. Anheuser-Busch produced 95 MILLION.

I agree, it would provide a tax break to all craft breweries. The point though is that for the majority of us who are under 3000 barrels but growing, it puts smaller breweries at an additional disadvantage to the regional ones.

Excise taxes are a minor expense compared to everything else. Heck, if you want to talk about job creation they’re about 1/3 of what our payroll taxes run. So a 1000 barrel brewery getting half its federal excise taxes back gets $3500. Not enough to buy a used fermenter, or hire even a part time worker. Heck, our landlord just upped our triple-net by half that. Yes, $3500 is better than a poke in the eye, but still, woo…

But at 18,000 barrels, you’d be getting $63,000 back. That’s a new sales person and a half. (“Where’s your other half?!?” Haha, tryin to keep it serious but light here.) That’s a marketing campaign. That’s a new 60+ barrel fermenter installed. That’s more than 500 new kegs. That’s debt and liabilities paid down. That’s dividends paid out to owners.

That’s the amount of profit that we made last year, and then immediately reinvested back into our business, suddenly granted to a competitor on the whim of a tax break.

So no, I don’t support it. Because yes, AB-InBev and the other big breweries make millions of barrels. But I’m not in competition with them. Other than in the most abstract sense, as the ‘Craft Brewery Movement’, on the macro level. The majority of breweries out there, either brewpubs looking to start distributing, or small production breweries trying to organically grow, aren’t fighting every day to take over Bud Lite taps, or to grab grocery shelf space from PBR. They’re fighting over local craft taps and shelf-space, all of which are increasingly dominated by regional craft breweries, who have more sales staff, more pull with distributors, and bigger marketing budgets. And it’s an uphill battle, and fair enough, that’s just business. It’s a great business, full of very friendly, helpful, and generally kickass people. But as a business decision, I can’t support giving tax breaks to my larger competitors under the guise of “It’s great for all craft brewers!”

It just isn’t.

Thanks, Kendall, for highlighting the effort the national Brewer’s Association and many breweries of all sizes are making on behalf of craft brewers.

Beer Intellegentsia: Fair enough. If you don’t support it, this is, of course, your choice. However, to put a fine point on this effort, it’s not all about you. This effort WILL help small breweries if successful because every dollar counts. And, as you point out, an extra dollar in your pocket will be reinvested in the brewery. I’m sure you, as with Fremont, need more kegs, hoses, clamps, etc and $3000 is a lot of kegs, hoses or clamps. Won’t that help?

The larger vision in craft, in our opinion, is to support this effort because it will help us all. Sure, it may help our competition, but that is the point: to look beyond our individual interests and think about this community as a whole. We want craft breweries to succeed. Sure, we’ll see each other in bars, stores and elsewhere as we all try to sell our beer, but this is a good thing. Think about this community as a whole and not just your brewery and it’s hard to argue that a fair tax structure that puts more money in our pockets will not help.

The needs of the many outweigh the needs of the few as our good friend Spock once said.

What brewery do you run? I know your alias but not your name. Not important but curious.

Whatever the reader decides on this subject, it is important to know that the VAST majority of craft breweries in this country support this effort because they see the benefits that will flow to all of us…even if it may help our competition. Because Beer Matters.

The majority of the benefit of this proposed legislation does not go to the majority of breweries. 80% of the craft breweries in the state produced less than 1,000 BBLs in 2014. They’re going to save less than $1,000 a year on average if this legislation passes.

Those that will enjoy significant dollar benefits are the bigger craft breweries such as those Beer Intelligentsia refers to. The top 10 breweries in the state would each have received a tax break of $175K on average in 2014 if this legislation passes (see http://en.wikipedia.org/wiki/List_of_breweries_in_Washington for the data used).

Does such a bias towards larger craft breweries truly further the craft movement? I don’t think it does.

A better solution would be one that focuses the benefit on the majority of breweries. How about breweries get exempted from paying any duty at all on their first 3,000 BBLs? And better still – to exempt these small breweries from their federal reporting requirements up to this number? (We could debate the specific number further, I’m just putting this out there.) Taking these really small breweries out of the reporting process altogether would save a ton of paperwork and time for some very small teams, and they’d also get a tax break that’s twice as significant as that proposed. And every brewery in the country would see some benefit from this change.

As proposed, it’s not a fair proposal for most of your small breweries out there.

Thank you for your comments. I would request that people identify themselves when leaving comments. Not publicly, but when you enter an email address. Please use a real address so I can verify who you are. I promise that I WILL NOT reveal your identity. (Not here. Not ever.) Two of the commenters here suggest that they are brewery owners, but they didn’t include an identifiable email address, and did not otherwise identify themselves or their breweries in the the comments they left, so we must take them at their word.

Matt, we all know who you are. Sara, obviously I mentioned you in the story.

Again, thank you all for your comments.

I’m certainly not disputing that a tax reduction will help all breweries. Every dollar counts and, as mentioned, is better than a poke in the eye.

But it’s disingenuous to call this an act that benefits all craft brewers, and trumpet just how many of us there are, and how hard we’re working, and how if we just had this tax cut, ohhh how we’d grow!

Some quick, slightly out of date, back of the napkin type numbers. Looking at Kendall’s 2013 numbers (linked in the article above) the Top 10 WA Breweries produced about 200,000 barrels of the state’s approximately 300,000, or 2/3 of the beer. Probably still a more or less accurate ratio today, though the total volume has grown. Even if it’s not as stark a division in 2015, I’m certain it’s still a big, big division. There’s 250 breweries in the state now. So by this act 4% of the state’s craft breweries, the Top 10, would get about 66% of the total value of the tax break. Add the next 10 largest breweries for another 15% of the sum. So 8% of Washington’s craft breweries receive 80% of the benefit from this proposed legislation. The remaining 230 of us will see the remaining 20% of the tax dollars divvied up. And it’s doubtless the exact same case in other states as well. Perhaps Matt meant to say “the needs of the many barrels outweigh the needs of the few.”

Because the argument for supporting the act boils down to: “Hey, we’re all going to get a pie. You all get a bite or two, while some of us will get slices. But that’s ok, because we all get pie!”

Which is technically true. Except an hour later I’m hungry. And you all still have pie.

From a logical perspective it’s completely fair. We all pay excise taxes proportionately, whether we make 6 barrels or 60,000. And the tax cut is fair, in the sense that everyone across the board gets a 50% cut on what they would have paid, under 60,000 barrels. (Not even getting into the tax break above 60,000 barrels.) But half our excise taxes, for small brewers, isn’t really all that much. However, it can be quite a bit for a brewery making twenty times the beer we do. Money to actually do things with. Things that could make it even harder for the rest of us to compete and grow in this ever-crowding market.

So while I normally support acts that benefit the craft brewing world in general, this largely benefits a small minority of it. It will certainly create some jobs, and lead to some new investment. No doubt about that. But for the 230 of us in the state that get to divvy up 20%, it’s not enough to do anything particularly useful.

But it’s being sold in our name. As some great benefit to all of us. And it just isn’t.

As Small Brewer suggests, there are many other rules and changes that could be made that would help the vast majority of craft breweries. Those in the sort of 4k range and below. (I’m sure statistics could find that particular percentile line better than me.) For example, the BA could push to ease our reporting burdens. If you really want to mess with excise taxes, ok, how about we stagger them, by say, every thousand or two barrels up to “regional” status. Do things like relaxing the requirements of our brewers bonds; that was great.

On the anonymity front. I understand your concern Kendall, and thank you for both spreading the news of Washington Beer and allowing a forum for commentary and discussion. But it’s a Small Beer World out there. I’d rather my comments be judged on their face than be colored by, or perhaps color, perception of our brewery out in the trade. So I hope you’ll post this (most likely) final reply. Whether a reader believes I speak for a small brewery or not in reality is certainly their choice. I’ve very much tried not to say anything offensive or incendiary, beyond “I disagree.” And I’m all ears if the argument I made is somehow incorrect, or unsupported by facts. I completely understand why some breweries would support this, and hope I’ve shown why some would not.

But right now, I’ve spent quite a lot of time on this and I think I’ve said my piece. It’s time to mill in for tomorrow and prep for another busy day brewing great Washington beer.

(And now it’s 6:00, to drink great Washington beer. Cheers!)

Why don’t we start with the fact that the money we’re talking about was generated by the hard work of the brewery. Not the government. Never the government. They just want to put their hand as far into my pocket as possible. Save me the lecture on whether I’m big or small. It’s my money. Period.

While I understand this issue has at least two sides worthy of debate, it is difficult to continue without knowing who we are talking to. If you run a brewery and expect your comments to be taken at face value, that value includes your legitimacy as a brewery owner. You can’t have it both ways: legitimacy from having a stake in this issue and anonymity.

If you would like to talk in person or email, my email address is matt@fremontbrewing.com

Fremont Brewing believes the SmallBREW Act will help all breweries. Sure, some breweries will receive a larger amount of tax relief than others. Our competitors will have more money to invest in their breweries. So be it. We compete on taste, not on the size of the brewery and we prefer to see all breweries get a break. We supported this Act when we brewed 1000, 3000 and 5000 barrels. We still support tax relief for craft brewers.

One more thing: I do appreciate the tone of both comments arguing against this issue. This level of respect and moderation of tone is rare in blogs and further differentiates craft brewing from other businesses. Colleagues often disagree but at least we can laugh at ourselves and enjoy a beer together.

Cheers!

I am fully supportive of the Brewers Association efforts to reduce our federal excise taxes. I guess we at Chuckanut are somewhere in between the other breweries commenting here in regards to our production and the economic impact it would have upon us. At this point we would probably see about $7,000 benefit. Yes, the larger craft breweries will easily see the biggest dollar gain. However, just because we are unable to gain a similar dollar benefit because we do not make anywhere near as much beer is not a good reason to reject this legislation. Perhaps if they structured it whereby every brewery, no matter how large or small, was able to gain a sales rep or see a $50,000 windfall then it would be acceptable.

Economies of scale, whether in the craft brewing segment or for mega breweries is the world we live in as brewers. Smaller and certainly smallest breweries will never realize the monetary benefits and impact afforded larger breweries. I would submit this is the case with virtually all manufacturing entities and types of manufacturing.

The fact that this benefit is equal for all breweries up to 60,000 barrels is not an economy of scale issue. It is a fair approach whereby larger breweries are unable to assert their size for added benefit. Apparently no legislation will receive total support these days, but that is no reason to not make advances to help our industry as a whole. I urge my fellow brewers to also support the Small BREW act.