By now, pretty much everyone knows about the “brewed the hard way” ad that Budweiser ran during the Super Bowl. It was widely considered a blatant attack on the basic nature of craft beer, a bracing slap in the face that did not go unnoticed by beer aficionados. It even earned the attention of the mainstream media and the less-beery public, which must make Budweiser’s advertising department dizzy with delight.

But was the multimillion dollar television spot more than a beer commercial? Was is actually a political attack ad? Is there more to this story than a bunch of upset, fussy beer geeks? Some members of Congress think so.

Some people in Washington, DC saw the Budweiser commercial as political mudslinging, or at least an attempt to sway public and political support in the direction of the big beer industry and away from the small beer industry. But why would Budweiser engage in political shenanigans?

BEER vs. BREW

There is a beer battle brewing in the other Washington, where Congress is considering two separate pieces of legislation that impact the tax rate breweries pay on the beer they produce: the BEER Act and the Small BREW Act.

There is a beer battle brewing in the other Washington, where Congress is considering two separate pieces of legislation that impact the tax rate breweries pay on the beer they produce: the BEER Act and the Small BREW Act.

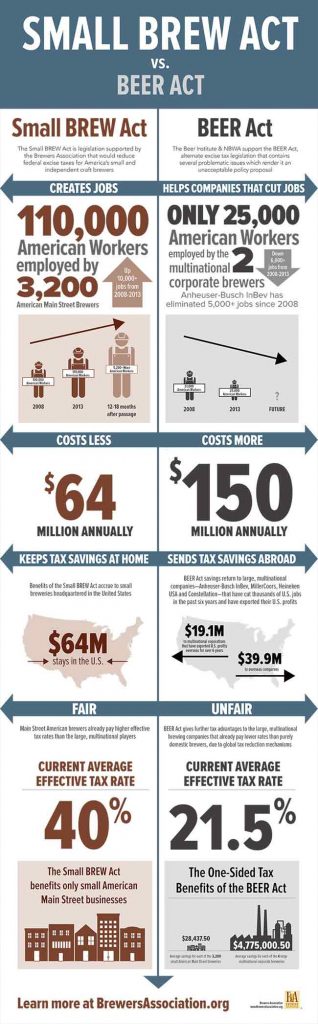

One is widely supported by big breweries, the other is supported by the Brewers Association and craft breweries. (Click on the infographic to see it full size.)

The BEER Act – Brewers Excise and Economic Relief Act – is supported by the Beer Institute, which represents big breweries like Anheuser-Busch, Miller-Coors and Heineken USA. Also supporting the BEER Act, the National Beer Wholesalers Association (NWBA), which is an organization comprised of the nation’s beer distribution companies.

According to the Beer Institute, the purpose of the BEER Act is to roll back what is seen as an unfair increase in the federal excise tax on beer, lowering the tax to its former fair levels. Former in this case means 40 years ago and fair is totally subjective. The current tax rate has been around since 1976.

Under the Fair BEER Act, all brewers and beer importers would pay a rising scale of federal excise tax:

- No excise tax on the first 7,143 barrels.

- $3.50/barrel on barrels 7,144-60,000.

- $16/barrel on barrels 60,001-2 million.

- $18/barrel on every barrel above 2 million.

- See more details on the Beer Institute website.

The Small BREW Act – Small Brewer Reinvestment and Expanding Workforce Act – is supported by the Brewers Association, which represents America’s independent, comparatively small breweries—the ones we know as craft breweries.

The Small BREW Act only impacts breweries producing less than 6 million barrels annually and:

- Reduces the small brewer federal excise tax rate on the first 60,000 from $7.00 per barrel to $3.50 per barrel.

- Institutes a new rate of $16.00 per barrel on beer production above 60,000 barrels up to 2 million barrels.

- See more details on the Brewers Association website.

Perspective

Just about all of Washington”s breweries produce less than 20,000 barrels per year. Elysian Brewing, Georgetown Brewing, and Mac and Jack’s Brewing are the only ones hovering around that 60,000 mark. Redhook is the only one producing more than 100,000 barrels annually.

In 2006, Anheuser-Busch produced about 161 million barrels (5 billion gallons) of beer. In 2008, Anheuser-Busch was acquired by the Belgian-Brazilian brewing company InBev, so production statistics for the A-B subsidiary in the USA are hard to pin down.

Why Reduce Taxes for Small Breweries?

Reducing the tax burden would allow America’s small breweries to grow, create new jobs, and otherwise increase overall tax revenues. Studies show that reducing the excise tax paid by America’s small breweries provides economic advantages that outweigh the disadvantages. If you want to read the study I’m talking about, click here to download the PDF. Also, read more on the Brewers Association website.

But not for the Biggest Breweries?

As the Brewers Association infographic shows, proponents of the Small BREW Act believe that reducing the tax rate for the biggest breweries, which produce about 100 million barrels per year, would result in too great a tax loss. Simply put, it would cost too much. Also, Small Brew Act supporters contend that since companies like Anheuser-Busch and Molson-Coors are owned by even larger, foreign companies, the savings from tax cuts do not have the same direct impact on the American economy; a tax reduction would only serve to increase profits that are shipped overseas.

SUPPORTERS

As far as breweries are concerned, I have yet to talk to a local, small, independent brewery that supports the BEER Act over the Small BREW Act. It is not a definitive study, but it is my personal observation that the breweries we love all stand in support of the Small BREW Act. It follows that this blog, which focuses on craft breweries and beer, supports the Small BREW act.

Admittedly, I don’t spend much time talking the people at Anheuser-Busch, Miller-Coors, or the even-bigger companies that own them. Logic suggests that breweries producing more than 6 million barrels annually have no interest in the Small BREW Act and support the BEER Act.

Congress

Senators and Representatives who stand in support of the Small BREW Act are members of the Senate Bipartisan Small Brewers Caucus and the House Small Brewers Caucus. As of January 15th, the House Small Brewers Caucus has 142 members and the Senate Bipartisan Small Brewers Caucus has 25 members. Which of Washington state’s Representatives and Senators are members of those caucuses? Who has signed onto a bill as a cosponsor? See below, bottom of post.

VIEW FROM 10,000 FEET

This is a high-level view of the issue, I admit. It gets really complicated really fast once you start to look deeper. In future posts I may provide more insight, but in the meantime, there is a wealth of information on the Internet about both acts.

Maybe the only thing you need to know is that the Brewers Association supports the Small BREW Act and the big beer companies support the BEER Act. Perhaps it is just a matter of where your allegiances lie. Educate yourself and form your own opinion.

SO, BEER COMMERCIAL OR MUDSLINGING?

Matt Laslo recently reported for the Daily Beast that some members of congress are as upset with the Anheuser-Busch commercial as the rest of us. I am, of course, talking about the infamous Super Bowl commercial that characterized craft beer as being overly fussy.

Representative Patrick McHenry (R, North Carolina) said, “I think it’s insane. I don’t think it’s the right approach. It’s like the first political attack ad on this thing, so like the politics of beer.”

McHenry is a craft beer lover with 25 small breweries in his Asheville, N.C. district.

Representative Peter DeFazio (D, Oregon) said, “They know that the craft beer industry is eating their lunch. More and more Americans are developing a taste for beer that isn’t insipid and has real taste, and so they’re now starting to buy them up.”

DeFazio is the founder and chair of the bipartisan House Small Brewers Caucus, which is dedicated to educating members of Congress and their staff about legislation, regulations, and other unique issues faced by small American breweries, so his allegiance is clear.

“So it kind of contradicts their ad. I mean, they’re trying to say, ‘Oh, come on back and buy the schlock,’ yet on the other hand, they’re out buying up the good beer,” DeFazio said, before he added a warning. “They better not change the formula’s cause people will just stop buying it and someone else will replace them.”

Less than 72 hours after the commercial aired, Senators Ben Cardin (D-Maryland.) and Susan Collins (R-Maine) reintroduced the Small BREW Act on the Senate Floor. You can watch the video below.

“I don’t think we ever intended for small businesses to be burdened with an excise tax, such as the beer tax,” Cardin said. “When we’re talking about a craft brew industry that is generally supporting small business and encouraging a new generation of people who really appreciate the art of brewing beer.”

You will likely be hearing more about all of these things in the coming months.

Matt Laslo is a veteran congressional reporter. In his free time he hosts Bills and Brews; a craft beer and politics show. Find him on Twitter @MattLaslo.

WASHINGTON STATE’S CONGRESSIONAL DELEGATION

Supporting an idea is one thing, but signing onto a bill as a cosponsor is another. At this point, the only member of Washington’s congressional delegation to co-sponsor the Small BREW Act (H.R. 232) is Representative Jim McDermott, who recently signed on as a cosponsor. (See the list of co-sponsors on the Brewers Association website.)

According to the Brewers Association, as of January 15, Senator Maria Cantwell is a member of the Senate Bipartisan Small Brewers Caucus, but Senator Patty Murray is not. Senator Cantwell is also signed onto the bill (S.375) as a cosponsor.

Seven of Washington’s ten Representative are members of the House Small Brewers Caucus.

- Suzan DelBene – District 1

- Rick Larsen – District 2

- Cathy McMorris Rodgers -District 5

- Derek Kilmer – District 6

- Jim McDermott – District 7 (co-sponsor)

- Dave Reichert – District 8

- Adam Smith – District 9

Not yet members of the House Small Brewers Caucus:

- Jaime Herrera Beutler – District 3

- Dan Newhouse – District 4

- Denny Heck – District 10

PROGRESS

The track the progress of H.R. 232 click here.

To track the progress of S.375 click here.

Time to write Senator Murray a letter!

Thanks for the knowledge.

I initially reported that two craft breweries supported the BEER Act. I was wrong and the article has been corrected.